Advocacy

Anti-Privatization Efforts

Vouchers

Vouchers are a failed shell game that shifts taxpayer dollars from public to private schools without improving students’ success. When we have billions in unmet needs in our public schools, any dollar dedicated to private schools—whether it’s $5 million, $10 million, or one dollar—keeps us from meeting those needs. The failed BOOST voucher program to which Governor Hogan gave millions of dollars should be eliminated.

Different voucher plans have been introduced in various forms since 2006 in the face of broad opposition, including from MSEA, the NAACP, League of Women Voters, Maryland PTA, Maryland Association of Boards of Education, and others. As recently as November 2022 the Great Lakes Center for Education Research & Practice reviewed and refuted the findings of a report recommending vouchers as a means to accelerate academic recovery after the pandemic. Simply put, vouchers have not delivered on the promise to improve student performance or public schools.

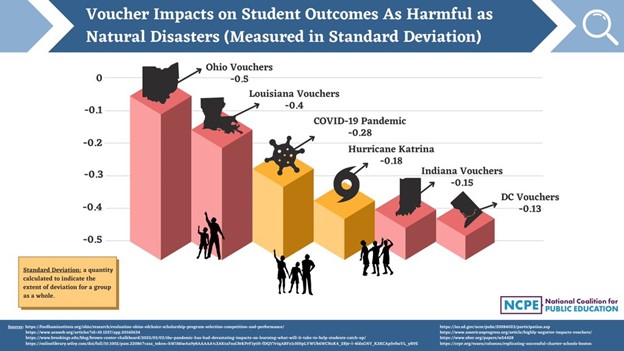

In fact, the National Coalition for Public Education found that vouchers caused more harm to student learning than natural disasters such as Hurricane Katrina or the pandemic. Studies found that voucher recipients in Indiana, Louisiana, Ohio, and Washington, D.C. were found to suffer moderate to severe declines in academic achievement.

In 2016, Gov. Hogan included $5 million for the BOOST voucher program in his budget, and he attempted unsuccessfully to increase it to $10 million every year after, succeeding in the FY23 budget. An overwhelming majority of those taxpayer dollars—nearly 70%—were distributed to families whose children already were enrolled in private schools. We can’t afford to fund two different school systems—public taxpayer dollars should be spent improving our public schools, not subsidizing expensive private schools. Incremental expansions of voucher programs since 2017 swelled in Indiana nearly 83% from $131 million to $240 million, and 58% in Florida, from $358 million to $568 million. We must make sure that Maryland doesn’t continue down this wasteful, unproductive path.

Charter Schools

In 2003, MSEA worked closely with the General Assembly to enact the Public Charter School Act. The bill created Maryland’s first public charter school program “to establish an alternative means within the existing public school system in order to provide innovative learning opportunities and creative educational approaches to improve the education of students.”

We believe that charter schools must meet the following criteria.

- Are under the control of local school boards

- All students are eligible

- Are held to the same standards as other public schools

- Staff members have the same collective bargaining rights as their counterparts in mainstream public schools

- Must be qualitatively different from what is available in mainstream public schools and not just an avenue for parental choice—that means successes in charter schools must be scientifically sound enough to be scaled up in traditional public schools

- Do not receive a disproportionate amount of state funding in comparison to traditional public schools

In fact, because of these criteria and strong vigilance in the review of each proposed Maryland charter school, the success rate of those approved is much higher than in many other states. MSEA believes that charter schools and other nontraditional public school options have the potential to facilitate education reforms and develop new and creative teaching methods that can benefit children. However, we believe success depends on how charter schools are designed and implemented, including strong oversight and assistance provided to charter school leaders. For background on what makes Maryland’s charter school law strong, read our 2013 white paper, “Protecting Maryland’s Charter School Law.”

Gov. Hogan’s Charter School Proposals

While we support Maryland’s charter schools and are open to further strengthening our already strong law, many of Gov. Hogan’s 2015 proposals were extreme, counterproductive ideas that would have lowered the state’s high standards for quality, accountability, and equity. Maryland’s high standards have supported a number of successful charter schools while avoiding the pitfalls experienced by states with lower standards. By the metrics of fostering accountability, fiscal responsibility, and educational quality, Maryland’s charter school law has proven to be one of the strongest in the country. Unfortunately, Gov. Hogan’s 2015 legislation went much too far and risked breaking the balance we have in Maryland now by:

- Disproportionately funding charters at the expense of traditional public school students

- Establishing a facilities funding system that risks wasting taxpayer dollars and delaying the needs of traditional public schools

- Allowing charter schools to hire uncertified teachers

- Giving charter schools the ability to dodge many state quality control standards

- Lowering standards for working and learning conditions by disempowering educators from having a strong voice in their workplace

- Allowing charter schools to avoid the most disadvantaged students

Due to the advocacy of public school educators, including many charter school teachers, the legislature removed the harmful provisions of Gov. Hogan’s legislation and instead amended it to make our charter school law even stronger. New provisions included:

- Giving greater weight in placement lottery to students below median income

- Ensuring that chartering authority is at the local level, rather than through a politically appointed State Board

- Instituting greater accountability and transparency measures during the charter application process

- Ensuring that professional staff meet the same certification requirements as employees of other public schools

In 2017, Gov. Hogan doubled down on the counterproductive ideas in his 2015 legislation, re-introducing many of them and compounding them with more misguided ideas, like giving charter schools more funding than traditional public schools and setting up the type of parallel system for charter schools (with lower levels of accountability and standards) that have caused bad outcomes for students and millions of dollars in the fraud, waste, and abuse of taxpayer dollars in other states with similar structures. Click here to learn more about Gov. Hogan’s 2017 charter schools bill. The bill was defeated in the General Assembly. We should focus on improving all of our public schools instead of mistakenly treating charter schools like a silver bullet solution.

FAQs

Q: Why does MSEA insist that charter schools admit all students?

A: All public schools are obligated to provide access to students regardless of their ability, special needs, parental involvement, etc. Charter schools should not be treated differently if they are to share financial resources. It would be unfair to expect the existing public schools to handle a disproportionate number of students with special needs and allow charter schools to pick and choose which students they will accept.

Q: Why does MSEA oppose private charter schools?

A: A school should have one goal—to provide the best possible education for the students. Private firms owe their first allegiance to the bottom line or making a profit for their investors. We believe that student welfare should never be competing with a company’s need to make a profit. We also believe that there should be adequate safeguards covering contract and employment provisions. That might not be possible in a private charter school run by a for-profit corporation.

Q: How does student achievement compare between charter and other schools?

A: Major studies of charter schools, including Stanford University’s 2013 Center for Research on Educational Outcomes study, find that while there are some exceptional charter schools, on the whole traditional public schools outperform charter schools. Learn more by reading this Washington Post recap of the Stanford study, “Charters not outperforming traditional public schools, report says.” Similar results have been found in Maryland.

Learn more about charter schools across the country.